Juki app for iPhone and iPad

Developer: Copernicus

First release : 11 Apr 2016

App size: 37.03 Mb

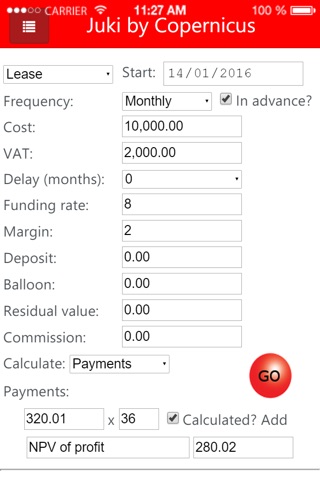

Juki is an asset finance calculator.

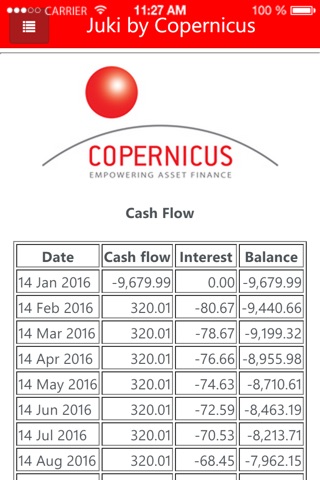

Juki may be run on a daily basis for the calculation of exact interest values or on an “equal periods” basis when it mimics calculators such as the HP12C where each month is one twelfth of a year.

The user can choose from GBP, USD or EUR. For USD and EUR a 360 day basis is used for daily interest calculations.

The user can also have Juki adjust for business days either moving to the next business day or the previous business day. As well as adjusting for weekends Juki has a list of public holidays for each currency up to 2030.

There is an option to “Use last day of month”. This option applies to a series of payments as follows:

i) If the option is set and the payments start on, for example, the 30th April then the next dates are 31st May, 30th June, 31st July and so on

ii) If the option is not set and the payments start on, for example, the 30th April then the next dates are 30th May, 30th June, 30th July and so on

Business day adjustments and “Use last day of month” are only relevant for daily calculations.

There is an option to set a VAT rate. This rate will be applied to the Cost (amount financed) to determine the VAT value.

For daily calculations the date is important since starting on different dates gives slightly different answers. The date is purely for information purposes when equal periods are used.

The user enters a Frequency (Monthly, Quarterly, Half-yearly or Annual) and also indicates whether the payment profile is in Advance or Arrears. For Advance the first payment is on the Start date and for arrears it is one Month, Quarter, Half-Year or Year after the Start date.

The user enters a Cost. If the VAT rate is non-zero the VAT on the Cost is calculated. This may then be amended manually if the VAT is not simply Cost * VAT rate / 100.

If you are processing an HP quote there is an option to delay the receipt of the VAT reclaimed by the lessee by 1, 2 or 3 months, “Delay (months)”. This will affect the pricing since the lessor has paid the VAT on day one.

Funding rate is the cost of funds to the lessor. Margin is the rate over the Funding rate representing the lessor’s profit.

Deposit is a receipt on day one.

Balloon and Residual value are both received on the last day of the quote. They are distinguished since if there is a Residual Juki will calculate the SSAP21 10% test to determine whether the lease is a finance or operating lease in which case the lease type and the NPV of the Residual is displayed.

A Commission may also be entered.

Deposit, Balloon, Residual and Balloon may be entered as a percentage of the Cost. Simple enter, for example, 10% in one of those boxes.

The NPV of profit is simply the Margin discounted at the Funding rate (cost of funds). You can set this value and then have the Payments or Margin calculated to achieve this NPV by simply touching another part of the screen.

Juki Premium is available for users who need that little extra. Juki Premium offers cloud storage for your quotes, so that they are available on any device, you can also export your quote to a nominated email address. It also allows you to open and update a quote you have been working on previously. Last but not least, you can also share your quotes between other users in your group.

Juki Premium is available for £39.99 per annum on an auto-renewable basis.

Privacy policy: http://www3.copernicus.co.uk/juki/#views/terms.html

Terms of use: http://www3.copernicus.co.uk/juki/#views/terms.html